A response to Democrats Are Better Money Managers:

A response to Democrats Are Better Money Managers: A response to Democrats Are Better Money Managers:

A response to Democrats Are Better Money Managers:

We start with a typical analysis of Bush's economic plans. From the LA Times, 2/7/03:

COMMENTARY

An Economic Plan That Cancels Itself

Bush's bid for both growth and a stimulus would achieve neither.

By Maya MacGuineas

Maya MacGuineas is director of the retirement security program at the New America Foundation.

President Bush's proposed budget blurs the important distinctions between stimulus and growth. Given the differing objectives of the two — on the one hand increasing spending to stimulate the economy in the short term and on the other increasing saving to boost longer-term growth — it is nearly impossible to accomplish both.

With the stimulus and growth components of the president's economic proposals canceling each other out, the budget plan is likely to accomplish neither.

When stimulus is the objective, deficit spending makes sense as a way to funnel more money through the economy to speed up recovery. An effective stimulus policy should be both targeted, to ensure that the funds are spent rather than saved, and temporary, to avoid an ongoing drain on the budget.

The purpose of a long-term growth package is the opposite. Changes in the tax code can minimize distortions that slow economic growth. One way is to encourage rather than punish saving and investment, which are the ultimate engines of growth.

So how does the Bush budget plan stack up?

Not well. His $360-billion plan to eliminate dividend taxes and vastly increase the individual saving that can be accumulated tax-free is structured primarily as a growth package — yet deficit-financed as though it were a stimulus. The result: Poorly targeted tax cuts would provide little promise of spurring short-term spending, while the fiscal drag from deficit financing would drain away any savings gains.

Though administration officials have been careful not to describe it as a stimulus package, the need to get the economy back on track is clearly a primary rationale for introducing a bold economic policy in the budget. How else could another round of tax cuts be justified, given burgeoning U.S. budget gaps and increasing costs of national security?

Even the most ardent supply-siders don't pretend tax cuts can cover these costs. It is only the presumption of the need for fiscal stimulus that justifies borrowing to pay for the package in the first place.

But the stimulus argument falls flat when you look at the timing and specifics of the economic proposals. Only the slimmest fraction of the money would enter the economy in 2003, with most of it falling in 2004 and beyond, well after recovery presumably will be underway. Moreover, the elimination of individual taxes on dividends and introduction of larger tax-free saving vehicles would encourage higher levels of saving and investment — a good thing in the longer run, but not when stimulating consumption is the goal.

Given its use of deficits to cover the cost of the saving incentives, it is equally hard to describe the new budget as oriented toward growth. Although the tax cuts would encourage individual saving, the drain on government saving from record deficits would more than offset those gains. Presenting Congress with a budget under which the national debt would rapidly mount from year to year is not a credible approach to increasing saving.

What is needed, then, is to treat the stimulus and growth portions separately. On the stimulus side, there is something to be said for scrapping the idea altogether. There is already so much stimulus in the U.S. economy from multiple interest rate cuts and the huge swing from budget surpluses to deficits that it is unlikely any of the proposals being discussed would make much of a difference.

If there is a need for stimulus, two options stand out as promising: aid to the states, which will otherwise have to balance their budgets through tax increases and spending cuts, creating an economic drag; and money for homeland security, funds that inevitably will have to be appropriated.

The proposed tax reductions on income from saving could serve as the centerpiece for a sensible package because they would move the tax system in the direction of being consumption-based, leading to more investment and faster growth. But rather than as part of a plan for tax cuts, such reductions should be included as part of a more comprehensive, revenue-neutral tax reform package. And they should be distributed evenly across the income spectrum, not going disproportionately to the wealthy.

A promising approach would pair the investment tax reductions with reductions in tax breaks that are inefficient and tend to favor the same high-earner investment class. We could limit the value of employer-provided health-care packages that can be exempt from income, which would crack down on the use of gold-plated insurance packages as tax shelters and bring better market pricing to the health insurance market. Also, the home mortgage interest deduction, which misallocates resources away from productive investment and into mansions, should be decreased to well below its current $1-million limit.

Out of the $800 billion in existing tax breaks, the money to create a balanced and revenue-neutral package would not be difficult to find. Otherwise, the current proposal makes doing nothing look pretty good.

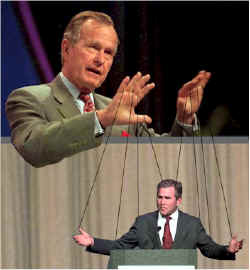

Cartoon sums it up (3/17/03)

We continue with a cartoon that summed up the Bush plan, which correspondent Rick objected to. The following are his comments and my responses:

>> the point was not whether or not the tax policies portrayed by bush are correct or not. the point is that the cartoon unfairly portrays bush tax policy as being directed solely at the reach, to the exclusion of the poor. <<

That's generally how editorial cartooning works—by simplifying a complex truth into a single picture. I didn't miss the point of how cartooning works when I forwarded the image; I understood it. I can't speak for what anyone else understood or didn't understand.

The cartoon didn't exactly suggest Bush was excluding the poor. It suggested he was ignoring the economy's major problems (the house on fire) while catering to the wealthy. That was true then and it remains true, as almost every expert has said.

See what the New York Times had to say about Bush's plan, 3/16/03:

The regressive 10-year plan, matched by an equally hypocritical Senate version, is a triumph of ideological rant over budget reality. Government now must be drastically crimped to pay for the rolling deficits resulting from Mr. Bush's triumphalist rewards for upper-bracket Americans.

The G.O.P. leaders endorse the next chunk of detaxation despite Congressional findings that two-thirds of the deficits running through the decade will be caused by the Bush tax cuts, not simply the failing economy.

And a Democrat in the LA Times, 3/16/03:

Matsui, a member of the tax-writing House Ways and Means Committee, cited economists who say the dividend tax cut will not lift the lackluster economy but will increase the debt.

"Who benefits from this tax cut?" Matsui asked. "Well, those earning $1 million or more a year would receive an average tax cut of $27,000 a year. But middle-income families earning $40,000 a year can expect a tax cut of $30 a year."

Sounds like everyone is saying about what the cartoon depicted, to me.

>> as your own email pointed out, the focus is on what benefits will accrue the middle class and how they will benefit. <<

Yes, and most of the benefits won't accrue to the middle class, as Matsui pointed out.

>> please define "middle class." if you look at the statistics, what most people view as "wealthy" is in fact the true middle class -- families earning solid earning up to $250,000 a year per household. <<

See Income Inequality (Middle Class)—Narrative on the subject.

There's no one definition. I think government and private economists each define it their own way when they develop their statistics. I don't know what one definition might be—perhaps the middle three of the five quintiles of family income? If I had to guess what the dollar range generally is, I'd say it's something like $20,000 to $80,000 or $100,000.

The "true middle class" isn't what anyone feels it is, it's what economists say it is. Sorry, but a $250,000 income would put a family in the upper middle class or, more likely, the upper class. I don't think more than 5% or 10% of Americans earn that much, so that family is wealthy by definition.

>> the other point of my email was the myth that these types of cuts are biased against the poor. <<

How Dubya deceives the public on tax cuts...from the LA Times, 3/3/03:

Most taxpayers and small-business owners would receive far less than this average amount because, in generating its figures, the administration has averaged the massive tax cuts that those at the top would receive with the far more modest tax cuts that those in the middle of the income spectrum would get. To illustrate how this deceptive use of averages works: If 10 people were in a room, nine of whom have low- and middle-incomes but one of whom is Bill Gates, on average all of these people are very rich. An analysis of Bush's tax-cut plan by the Urban Institute-Brookings Institution Tax Policy Center shows that the average cut for filers in the middle fifth of the population—folks right in the middle of the income spectrum—would be $256, a quarter of the $1,083 figure the administration cites for the average taxpayer.

>> is it a step in the right direction to reduce the burden of taxes on all americans -- definitely. <<

During wartime? When the plan threatens to boost the deficit to $1.8 trillion and mire the government in annual deficits as far as the eye can see? Not definitely.

>> this may not be the right solution, but at least bush is putting the question out there to be debated as opposed to previous adminstrations who talked about reducing the burden on the tax payers and turned around and increased it. <<

Clinton's previous administration oversaw the greatest economic boom in American history. So far Bush has given us a recession and a flatline economy. I'll take the former over the latter any day.

>> take a look at the difference in the tax burden from 50 years ago to today and tell me that the burden is the same and that is ok with you. <<

It's okay with me. See above about the greatest economic boom in US history.

>> by the way, the dividend cut would help virtually all of my friends -- none of whom are rich. <<

It'll help Bill Gates and other multimillioniares even more. The problem is that it won't help the overall economy.

The debate continues (5/12/03)....

>> please take a look at any economic indicators and they will ALL tell you that the recession actually began while CLINTON was still in office. <<

When conservatives claim the recession "began" during Clinton's term, they mean the economy started slowing down then. I believe the actual recession—the two quarters of negative growth—occurred during Bush's term. He had the presidential power then but did nothing to stop them.

>> pretty hard to blame bush for the economy when he wasn't in office. <<

He's been in office more than two years now. The economy is still flatlining. Most economists think his "plan"—eliminating the dividend tax—will do nothing to restart the economy. If we're lucky, the public will give him the boot for his abysmal domestic performance.

The debate continues (7/13/03)....

>> Check with the Federal Reserve on when the recession started. It was during Clinton's final year in office. Of that fact, there is no doubt. <<

I repeat, the economic decline may have started during Clinton's term. The actual recession started during Bush's. If you disagree, you check with the Federal Reserve and send me the evidence.

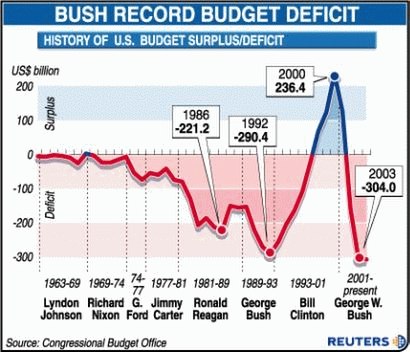

Also check when the economy reached its lowest point: right now, on Bush's watch.

>> To say the economy is flatlining and it is strictly Bush's fault ignores so many factors as to border on naivete or pure political animus. <<

Well, the economy is flatlining. As you might say, of that there is no doubt. As for whose fault is, I'm willing to blame the GOP Congress or Bush's ill-considered war on Iraq as well as his egregious mismanagement of the economy. I don't see Democrats in charge of anything on a national level.

>> As you undoubtedly know, it is not a simple thing to turn around a multi trillion dollar economy. <<

Especially when you're doing the opposite of what most economist would recommend.

>> Please tell me what you would do, or what the politician's you support would do that in the same period of time would have created a robust economy? <<

How about targeted tax cuts for the poor and middle classes?

>> Expanded health care? Tax increases to close the deficit? Those types of policies seem to be working well for Gray Davis and California. <<

Bush and the GOP are pushing to expand Medicare's prescription drug benefit—while stupidly giving away the money to pay for it. Tax increases to close the deficit are better than exacerbating the deficit—mortgaging our future with mountains of debt. See Bill Clinton's record of reducing the deficit and increasing growth for a better approach.

With minor exceptions, Gray Davis hasn't increased taxes yet. The GOP's alternative—borrowing to put California further in debt—is a joke. If there's one economist who supports that approach, I haven't heard him.

I think the LA Times's Steve Lopez put it best in his 7/11 column:

My more astute readers insist the governor could quickly balance the books by using the line-item veto, or by busing illegal aliens back home, or by "eliminating fraud." Others claim President Bush is responsible for California's problems because of his thieving pals in the energy business.

All of these people should be avoided at parties. They speak a sliver of truth, but on the whole, they are simpletons who see the world in black and white, without complexity or nuance.

Whether you care to hear it or not, there ain't much wiggle room in the budget because of pensions, salaries and hundreds of other fixed costs. That's why the most sensible solution is to trim some programs here, raise some taxes there, and be more conservative next time the economy fattens up.

But that's hard to comprehend for the average ding-dong who gets his news in 10-second snippets sandwiched between car chases on the 11 o'clock news.

>> Please explain to me how anyone is better off with higher taxes. <<

Society is better off paying for the services its members want. Environmental protections so Bush doesn't gut our national parks or poison us with arsenic in the water. Corporate oversight and IRS enforcement so Bush's buddies don't rob us blind. Homeland security so terrorists don't enter through every port Bush has left unprotected. Etc.

For instance, you apparently wanted a war on Iraq. It's going to cost you (and me, unfortunately) $3.9 billion a month. Where do you think that money comes from: a printing press? No, get out your wallet and start paying the tab. You wanted it; you got it.

'Tis true that governments cannot be supported without great charge, and it is fit everyone who enjoys a share of protection should pay out of his estate his proportion of the maintenance of it.

John Locke

The subjects of every state ought to contribute toward the support of the government, as nearly as possible, in proportion to their respective abilities; that is, in proportion to the revenue which they respectively enjoy under the protection of the state ....[As Henry Home (Lord Kames) has written, a goal of taxation should be to] "remedy inequality of riches as much as possible, by relieving the poor and burdening the rich."

Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations, 1776

Taxes are what we pay for civilized society.

Oliver Wendell Holmes Jr., Compania de Tabacos v. Collector, 1904

The debate continues (1/15/05)....

>> there are so many holes in your logic it is almost funny. the economy, for example is not at its lowest point right now. <<

I said the economy reached the lowest point "on Bush's watch," not when I wrote the message. That remains a true statement. If it's an example of a hole, it's not in my message.

I don't believe I ever said Bush was an economic nightmare. I said his record was mediocre if not poor and Kerry could've done better. If Kerry had merely emulated Clinton, he could've done a lot better.

>> in fact, if you read the la times recently, the projection is for growth in the 3 to 4 percent range for this year. <<

This year wasn't 2000 or 2001. Besides, the economy was flatlining—failing, actually—in terms of job creation, among other things. Bush still has lost more jobs than he's created.

This is a difference in outlooks, in choosing what's important, not a flaw in logic. You can trust me on that one, since I was the No. 1 math student in high school and a Phi Beta Kappa math major in college as well as an MBA at a top 5 b-school.

>> please explain how targeted tax cuts to the group of people who pay the smallest portion of the overall tax base will actually help the economy? <<

The poorer you are, the faster you spend your money. If you give $1 to each of a thousand people, they'll spend it much faster than if you give $1,000 to one person. When you take the multiplier effect into account, poor people will spend the money much, much faster. And every dollar spent and respent helps the economy grow, of course.

>> the same is true for the democratic plan to give child tax refunds to people who didn't pay any taxes last year. how do you give a refund to someone who pays zero? <<

The Democratic plan was to give more of the tax cuts to the middle class. They pay more in taxes than zero.

>> that is a tax give away of my money. <<

I'm shocked to learn that people who voted for Bush are thinking primarily of themselves.

>> so, because davis didn't raise taxes that means that he has done a good job running the california economy? get real. the state is in horrible shape and it is entirely his fault. <<

Didn't you once say the president has no effect on the economy? What economic powers do you think a governor has that the president doesn't?

Actually, we can attribute the condition of any economy, federal or state, to the actions of the executive and the legislature in charge. At least in part.

The state's in "horrible shape," in part, because selfish voters passed Prop. 13. Because a succession of Republican governors (Deukmejian, Wilson) underfunded the infrastructure. Because energy companies created an artificial crisis by manipulating the market. Because the Clinton economic boom went bust under Bush. Because the dot-com explosion imploded. Etc.

Entirely Gray Davis's fault? Not even close.

Bigger is badder?

>> he grew the state government by 40% in his tenure, in the process wiping out a mulit billion surplus. <<

And Schwarzenegger has grown it another 20% or 30% while putting the state $15 billion in hock so far, with more debt to come. But he's a Republican, so you probably think he's a good money manager. Despite the voluminous evidence that Democratic administrations manage the economy better than Republican administrations do. (See Democrats Are Better Money Managers for details.)

Growing the state government isn't a sin if the situation warrants it. When a population increase spurs an increase in the demand for government services (police, roads, libraries, etc.), the government should grow. Otherwise, people suffer.

>> and for clinton's record, I can find a large number of economists who will argue quite convincingly that those growth in the 90's was a direct result of the tax cuts under reagan in the 80's. <<

Then go ahead and find them. Prove the evidence actually exists.

>> and please don't quote columnists in the times as if they are experts. they are just ordinary people with their own agendas and opinions. <<

You could say that about any economists, whether they're columnists or not. Nevertheless, I've cited more economists than you have so far, since you haven't cited any.

>> I guess I am not that familiar with steve lopez's credentials to use him as the expert to support your arguements. what is is degree in? where was his doctorate? <<

I forget, but it's irrelevant. The posting that started this debate came from Maya MacGuineas, who was described as "director of the retirement security program at the New America Foundation." If she's a columnist, I've never heard of her before. I'd guess she's an economist who happened to write one column.

FYI, economists who work at universities and think tanks routinely write books, articles, and columns. Disseminating their work in writing is part of their job.

As for Lopez, he was merely summarizing the views of others. I said that he put it well, not that he crunched the numbers well. In other words, I praised him for his writing style, not his economic analysis.

>> for paying for services that I want, please tell me why I am paying social security if I don't want it? <<

You're paying for "insurance" so the rest of society doesn't have to take care of you in your old age. But surely you haven't bought into Bush's lies about a "crisis" in Social Security. Even Republicans are balking at calling a minor shortfall starting in 2042 a crisis.

I'd support a revision of Social Security if Bush could do it without increasing his world-record debt any further. When Bush proposes such a plan, I'm sure I'll hop on his bandwagon.

>> why am I paying for any number or ridiculus government programs that have nothing to do with the national well being and all to do with pork for local politicians? <<

What, like defense spending? Corporate welfare? Farm subsidies? Unnecessary wars? Ask your Republican buddies about that. Bush is the one who's expanding the size of government at present—starting with his big increase in Medicare. Even you can't find a way to blame this government expansion on Clinton, though you're welcome to try.

Why are we (Republicans) paying businesses?

>> why for example are we paying subsidies for milk producers that lead to california paying higher prices than the rest of the country for milk? why do we pay to advertise mcdonalds overseas? why do we pay farmers to NOT grow crops when many in the world are starving? <<

Why hasn't Bush or Schwarzenegger eliminated these subsidies? Because Republicans are bigger supporters of subsidies than Democrats are.

Schwarzenegger, for one, is giving gifts left and right to big business while claiming he opposes "special interests." I guess no one told him that corporations are the biggest special interest of all.

Bush has had four years to do something about farm subsidies. I guess he's been too busy breaking treaties, alienating allies, and killing Iraqis to think about them. How much do you want to bet he won't do anything about them in the next four years?

Here's proof of how Republicans love farm subsidies and other forms of corporate welfare. They're certain to pay off their rich supporters even if it means hurting poor people. From the Associated Press, c. 3/12/05:

Congress Mulls Cutting Food Aid to Poor

By LIBBY QUAID

Associated Press Writer

WASHINGTON (AP) — Cuts in food programs for the poor are getting support in Congress as an alternative to President Bush's idea of slicing billions of dollars from the payments that go to large farm operations.

Senior Republicans in both the House and Senate are open to small reductions in farm subsidies, but they adamantly oppose the deep cuts sought by Bush to hold down future federal deficits.

The president wants to lower the maximum subsidies that can be collected each year by any one farm operation from $360,000 to $250,000. He also asked Congress to cut by 5 percent all farm payments, and he wants to close loopholes that enable some growers to annually collect millions of dollars in subsidies.

Instead, Republican committee chairmen are looking to carve savings from nutrition and land conservation programs that are also run by the Agriculture Department. The government is projected to spend $52 billion this year on nutrition programs like food stamps, school lunches and special aid to low-income pregnant women and children. Farm subsidies will total less than half that, $24 billion.

>> The list is endless, so don't talk about what we have to pay for. <<

Yes, the list of Republican giveaways sure is endless. Since I generally oppose farm subsidies, I couldn't agree more.

If you want to talk about giveaways, how about the massive bailout Bush gave to airlines after 9/11? I was willing to let a few airlines fail, but he spent your tax money to keep corporate bigwigs in the money.

>> we are amongst the very highest taxed populations in the world and the highest (or second highest) in state taxes. <<

On the national level, I don't think so. US income tax rates are lower than most of Europe's and we don't have to pay a value-added tax. Taxes are so high in some European countries that people have emigrated rather than pay them.

On the state level, wrong. We're something like 18th when you figure in all the state taxes we pay—income, property, sales, etc. Here's the documentation

Some Facts on (Personal) Taxes, Spending and Business Friendly Policies

which took me a few seconds to find with Google.

And don't bother saying this statistic comes from the liberal media or a liberal website. It's derived from 2002 tax data from the federal government. You know, the borrow-and-spend government presently run by Republicans? If you can't trust them, who can you trust?

>> our school test scores are awful, the state services are weak and getting weaker. <<

Maybe Schwarzenegger's breaking his promise not to cut education funding will cure our schools. Maybe Bush's underfunded No Child Left Behind program will do the trick. But I doubt it.

With Schwarzenegger taking money from higher education, transportation, local government, etc., I'm not sure how he plans to make the state better. Oh, wait. Maybe he'll give the money to taxpayers. Then we can personally spend it on the UC system, freeways, police protection, and so forth.

Is that how you plan to solve the problems you listed? Because giving tax money to individuals so they can buy more PCs, minivans, or European vacations sure won't solve them.

>> so your solution is to raise taxes further to spend good money after bad to repair the system? <<

No, my solution is to manage the government portion of the economy like Clinton did—by balancing the budget and running up a surplus, thus creating an economic boom. Not by introducing massive new spending programs like a war on Iraq (Bush), and not by passing bond measures to cover up a growing debt (Schwarzenegger).

Neither Bush nor Reagan could do squat without massively increasing the US debt. Clinton could. That probably explains why Democrats rank higher as economic managers overall.

I guess the holes in my logic must be in another message, because they sure aren't in this one. What you've offered are differences of opinion, generally not backed by facts, not flaws in my arguments. Next time you talk about logic holes, I hope you'll actually present one.

Big Brother Rob

Another correspondent chimes in

>> You are so good at rebuttals, you should have been an attorney! <<

I didn't even address his ridiculous claim that Reagan's tax cuts caused Clinton's economic boom. Hello! George Bush, who was president between Reagan and Clinton, raised taxes and suffered a recession (the biggest one since the Reagan recession). Does Rick think Reagan's tax cuts skipped the Bush years and leapt directly to the Clinton years? How could they boost Clinton's economy without boosting Bush Sr.'s economy more?

No economist claims that a president's actions take effect only four or more years after his administration. Most economists say any effect happens immediately or in a year or two. That's one reason Rick will never present any evidence to bolster his claim.

Related links

Schwarzenegger the girlie-man governor

Are taxes "theft"?

Faith in free markets

America's culture wars (economic)

|

. . . |

|

All material © copyright its original owners, except where noted.

Original text and pictures © copyright 2007 by Robert Schmidt.

Copyrighted material is posted under the Fair Use provision of the Copyright Act,

which allows copying for nonprofit educational uses including criticism and commentary.

Comments sent to the publisher become the property of Blue Corn Comics

and may be used in other postings without permission.