Despite the right-wing propaganda, Democrats are better money managers than Republicans. The facts are pretty much incontrovertible. If you're a sadly deluded conservative, read 'em and weep:

Despite the right-wing propaganda, Democrats are better money managers than Republicans. The facts are pretty much incontrovertible. If you're a sadly deluded conservative, read 'em and weep: Despite the right-wing propaganda, Democrats are better money managers than Republicans. The facts are pretty much incontrovertible. If you're a sadly deluded conservative, read 'em and weep:

Despite the right-wing propaganda, Democrats are better money managers than Republicans. The facts are pretty much incontrovertible. If you're a sadly deluded conservative, read 'em and weep:

There's Nothing New About Big-Spending PresidentsFiscal Policies of US Presidents

Over the last 100 years, of the five presidents who reigned over the largest domestic spending growth, four were Republicans. Taken in order of expenditures, they were Richard Nixon, Herbert Hoover, Dwight Eisenhower, Harry S. Truman (the lone Democrat), and George Bush. This ranking was obtained by measuring the change in domestic spending as a percentage of gross domestic product (GDP) between the fiscal year of a president's inauguration and that of his successor's inauguration. For example, the measure for Bush would be the change in domestic spending as a percentage of GDP between Fiscal Years 1989 and 1993.

From the LA Times, 8/1/04:

Michael Kinsley: Democrats vs. the GOP: Do the Math

You know how sometimes, when it's really, really hot, you get this urge to crank up the old spreadsheet, download a bunch of numbers from the Web and start crunching away like there's no next fiscal year?

Me neither. But I did spend a bit of the past week watching the Democratic convention on TV, and I needed something to exercise my mind while that was going on. Convention season is the one time every four years when we pretend that political parties matter. In general, we have accepted the reality that campaigns for national office have become entrepreneurial, united more by shared political consultants than by old-fashioned parties.

So I thought I'd see if there was a difference between the parties that transcended the differences between the candidates. Is one of them, for example, a better steward of the economy? One year won't tell you much, or even one administration. But surely differences will emerge over half a century or so, if they exist.

With that thought, I headed for the Web. Specifically, I went to the charts attached to the President's Economic Report, released in February. There, I downloaded like a madman and then distilled the mess into a few key stats.

The figures I'm using are from 43 years, 1960 through 2002. I didn't choose the years in order to skew the results; these are the years that were available for the categories I wanted to include.

The results are pretty interesting. Maybe presidents have little power over the economy. And we know that they must fight with Congress over the budget. Still, elections are based on the premise that who you vote for does matter. So let's at least entertain that assumption for a few minutes.

It turns out that Democratic presidents have a much better record than Republicans. They win in a head-to-head comparison in almost every category. Real growth averaged 4.09% in Democratic years, 2.75% in Republican years. Unemployment was 6.44%, on average, under Republican presidents, and 5.33% under Democrats. The federal government spent more under Republicans than Democrats (20.87% of GDP, compared with 19.58%), and that remains true even if you exclude defense (13.76% for the Democrats, 14.97% for the Republicans).

What else? Inflation was lower under Democratic presidents (3.81% on average, compared with 4.85%). And annual deficits took more than twice as much of GDP under Republicans than Democrats (2.74% of GDP versus 1.21%). Republicans won by a nose on government revenue (i.e., taxes), taking 18.12% of GDP, compared with 18.39%. That, of course, is why they lost on the size of the deficit.

Personal income per capita was also a bit higher in Republican years ($16,061 in year- 2000 dollars) than in Democratic ones ($15,565). But that is because more of the Republican years came later, when the country was more prosperous already.

There will be many objections to all this, some of them valid. For example, a president can't fairly be held responsible for the economy from the day he takes office. So let's give them all a year. That is, let's allocate each year to the party that controlled the White House the year before. Guess what? The numbers change, but the bottom-line tally is exactly the same: higher growth, lower unemployment, lower government spending, lower inflation and so on under the Democrats. Lower taxes under the Republicans.

But maybe we are taking too long a view. The Republican Party considers itself born again in 1981, when Ronald Reagan became president. That's when Republicans got serious about cutting taxes, reducing the size of government and making the country prosperous. Allegedly. But doing all the same calculations for the years 1982 through 2002, and giving each president's policies a year to take effect, changes only one result: The Democrats pull ahead of the Republicans on per capita personal income.

As they say in the brokerage ads, past results are no guarantee of future performance.

From the LA Times, 9/19/04:

THE ECONOMY

Who's Better in the Driver's Seat?

Under Democratic presidents, the engine hums along

Author: Arthur I. Blaustein; Arthur Blaustein was chairman of the President's National Advisory Council on Economic Opportunity during the Carter administration. He is a professor at the University of California,Berkeley, where he teaches social and economic policy. His most recent books are "Make a Difference" and "The American Promise."

A businessman who voted for President Bush four years ago and Bill Clinton in 1996 told me that John F. Kerry's social-program goals "seem good, but I'm worried the Democrats can't manage the economy as well [as Republicans], and they'll get into my wallet." Many voters agree, according to pollsters. But are Republicans better economic managers than Democrats?

Since we entered an entirely new phase of presidential politics 25 years ago, this question has become harder to answer in a full and open manner. Today's campaign imperatives are who can raise the most money and package the most attractive media image, not who can best demonstrate competence and capacity to govern. But fortunately, we don't have to depend on campaign slogans or advertising bucks to frame the debate. We can look to the record.

Here's the Economic Sweepstakes Quiz. The rules are simple. Guess which president since World War II did best on these eight most generally accepted measures of good management of the nation's economy. You can choose among six Republicans Dwight D. Eisenhower, Richard M. Nixon, Gerald Ford, Ronald Reagan, Bushes 41 and 43 and five Democrats Harry Truman, John F. Kennedy, Lyndon B. Johnson, Jimmy Carter and Clinton. Which president produced:

1. The highest growth in the gross domestic product?

2. The highest growth in jobs?

3. The biggest increase in personal disposable income after taxes?

4. The highest growth in industrial production?

5. The highest growth in hourly wages?

6. The lowest misery index (inflation plus unemployment)?

7. The lowest inflation?

8. The largest reduction in the deficit?

The answers are:

1-Truman; 2-Clinton; 3-Johnson; 4-Kennedy; 5-Johnson; 6-Truman; 7-Truman; 8-Clinton.

In other words, Democratic presidents trounced Republicans eight out of eight.

If this isn't enough to destroy the perception that the economy has performed better under Republicans, then let's include stock market performance under Democrats. The Dow Jones Industrial Average during the 20th century rose an average of 7.3% a year under Republican presidents. Under Democrats, it jumped 10.3%, a whopping 41% gain for investors. During George W. Bush's first three years as president, the stock market declined 4%.

Moreover, since World War II, the national debt increased on average by 3.7% a year under Democratic administrations, compared with 9.1% when Republicans occupied the Oval Office. During the same period, Democratic presidents oversaw on average an unemployment rate of 4.8%. For Republicans, it was 6.3%.

That's the historical record. What about current policies?

The Clinton administration presided over the longest peacetime economic expansion in U.S. history. The national debt fell dramatically, the industrial sector boomed, wages grew and more Americans found jobs. In contrast, the Bush administration has presided over the weakest job-creation cycle since the Great Depression, record household debt, the highest-ever bankruptcy rate and a substantial increase of those who live in poverty.

Kerry maintains that government has the responsibility to keep the economy on the right track. Toward that end, he has pledged to reduce the national debt and budget deficit. He would help the middle class and working poor by maintaining current benefit levels and eligibility for the earned income tax credit. Kerry has also promised to restore tax progressivity and fairness by rolling back Bush's giveaways to taxpayers earning more than $200,000 annually. And the Massachusetts senator wants to make significant investments in healthcare, education, affordable housing and the environment.

The president, by contrast, has emerged as little more than a supply-sider in the mold of his father, George H.W. Bush, and his father's former boss, Reagan. The results demonstrate why supply-side policies are sometimes called "trickle-down" economics. Corporate profits have soared 57.5% during the Bush administration, while workers' wages and benefits have increased a minuscule 1.57%.

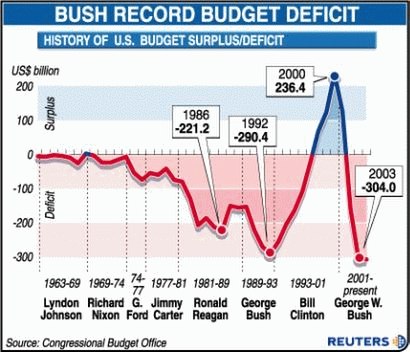

In less than a year and a half, the Bush administration's sweeping tax cuts, passed by Congress in 2001, wiped out the federal government's 10-year projected budget surplus of $1.6 trillion. In 2000, the budget surplus was $236 billion. Three years later, the surplus had turned into a deficit of $375 billion.

Because Bush believes the free market will solve America's economic problems, he wants to gradually privatize Social Security and Medicare. To finance current government spending after having given the wealthiest 1% of Americans 43% of the tax cuts Bush is borrowing more heavily from the Social Security trust fund than any previous president. At the same time, the Treasury owes billions to foreign investors who buy Treasury bonds, and thus subsidize the national debt, which has soared by 29%, to $7.3 trillion.

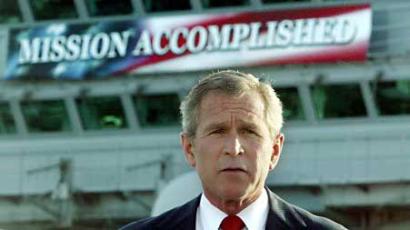

Bush's solution to the recovering economy's still-uneven job creation is more tax cuts for the wealthiest individuals and corporations. The cost of these tax breaks plus his proposed spending initiatives is estimated to be $3 trillion over a decade. In denying the tax cut's role in the nation's current budgetary problems and placing the blame instead on Sept. 11 and corporate malfeasance the administration is being dishonest with the public.

During the 2000 campaign, Bush and his running mate, Dick Cheney, bragged about their MBA and CEO credentials, respectively. We've learned what that means: fudging, manipulating, wheedling government contracts and favors, and, in general, working the system for all it's worth. Bush and Cheney were schooled in a corporate culture that believes success involves exploiting the government, the economy and the environment.

They now practice that culture in the White House. To them, the national treasury seems little more than a personal piggy bank to reward their corporate friends and largest campaign contributors.

We don't need more quick-fix schemes or lopsided tax cuts. Four more years of Reaganomics II could land us on the economic endangered nations' list. Ballooning deficits and private debt could strangle the economy for the next generation, and all but the wealthiest would have a tough time making ends meet.

Kerry understands these realities and has demonstrated a willingness to confront them with candor, fairness and vision. We need an administration that understands and believes in coherent, comprehensive and equitable policies that promote sustainable economic growth and, on that count, Democrats have the winning record.

Copyright 2004 Los Angeles Times

From the LA Times, 4/3/05:

More GOP Than the GOP

Michael Kinsley

It was the TV talker Chris Matthews, I believe, who first labeled Democrats and Republicans the "Mommy Party" and the "Daddy Party." Archaic as these stereotypes may be, they do capture general attitudes about the two parties. But we live in the age of the one-parent family, and it is Mom, more often than Dad, who must play both roles.

It has not escaped notice that the Daddy Party has been fiscally misbehaving. But it hasn't really sunk in how completely the Republicans have abandoned allegedly Republican values if, in fact, they ever really had such values.

Our text today is the 2005 Economic Report of the President. I did this exercise a year ago, and couldn't quite believe the results. But the 2005 data confirm it: The party with the best record of serving Republican economic values is the Democrats. It isn't even close.

The values I'm referring to are widely shared. We all want prosperity, we oppose unemployment, we dislike inflation, we don't enjoy paying taxes, etc. They're Republican only in the sense that Republicans are supposed to treasure them more, and to be more reluctant to sacrifice them for other goals, such as equality or clean air.

Statistics in the Economic Report back to 1960 tell the story. And a consistent pattern over 45 years cannot be explained away by shorter-term factors, like war or who controls Congress. Maybe presidents can't affect the economy much. But the assumption that they can and do is so prominent in Republican rhetoric that they are stuck with it.

Consider federal spending (a.k.a. "big government"). It has gone up an average of about $50 billion a year under presidents of both parties. But that breaks down as $35 billion a year under Democratic presidents and $60 billion under Republicans. If you assume that it takes a year for a president's policies to take effect (so, for example, President Clinton is responsible for 2001 and George W. Bush takes over in 2002), Democrats have raised spending by $40 billion a year and Republicans by $55 billion.

Leaning over backward even further, let's start our measurement in 1981, the date when Ronald Reagan took office on a platform of shrinking government and many Republicans believe that life as we know it began. The result: Democrats still have a better record at smaller government. Republican presidents added more government spending for each year they served, whether you credit them with the actual years they served or with the year that followed.

Now look at federal revenues (a.k.a. taxes). You can't take it away from them: Republicans do cut taxes. Or rather, tax revenues go up under both parties, but only about half as fast under Republicans. This is true no matter when you start counting, or whether you give a president's policies that extra year to take effect. It's the only test of Republican economics that the Republicans win.

That is, they win if you consider lower federal revenues to be a victory. Sometimes Republicans say that cutting taxes will raise government revenues by stimulating the economy. And sometimes they say that lower revenues are good because they will lead (by some mysterious process) to lower spending.

The numbers in the Economic Report undermine both theories. Spending goes up faster under Republican presidents than under Democratic ones. And the economy grows faster under Democrats than Republicans. What grows faster under Republicans is debt.

Under Republican presidents since 1960, the federal deficit has averaged $131 billion a year. Under Democrats, that figure is $30 billion. In an average Republican year the deficit has grown by $36 billion. In the average Democratic year it has shrunk by $25 billion. The national debt has gone up more than $200 billion a year under Republican presidents and less than $100 billion a year under Democrats. If you start counting in 1981 or attribute responsibility with a year's delay, the numbers change, but the bottom line doesn't: Democrats do Republican economics better than Republicans do.

As for measures of general prosperity, each president inherits the economy. What counts is what happens next. Let's take just two measures, although they all show the same thing: Democrats do better under every variation.

From 1960 to 2005, the gross domestic product measured in year-2000 dollars (in other words, taking inflation into account) rose an average of $165 billion a year under Republican presidents and $212 billon a year under Democrats. Measured from 1989, or with a one-year delay, or both, the results are similar. And how about this one? The average annual rise in real per capita income (that's the statistic that puts money in your pocket): Democrats score about 30% higher.

Democratic presidents have a better record on inflation (averaging 3.13 % versus 3.89% for Republicans) and on unemployment (5.33% versus 6.38%). Unemployment went down in the average Democratic year, up in the average Republican one.

Oh yes, almost forgot: If you start in 1981 and if you factor in a year's delay, inflation under Republican presidents averages 4.36%, while under Democrats it's 4.57%. Congratulations.

From the Bangor Daily News:

Bush vs. Clinton: a tale of two economies

By Bangor Daily News Staff

Thursday, October 26, 2006 Bangor Daily News

By Edwin Dean

Republican leaders, and Republican-leaning columnists like George Will, claim that the Bush administration has produced a strong, growing economy. Don't believe it. A comparison of Bush's economic performance to Clinton's shows how weak the Bush economy has been.

Economic conditions under Bill Clinton were, without doubt, the best in three decades, and among the best since World War II. Unemployment fell from 7.5 percent in 1992, the last year before Clinton's inauguration, to 4 percent in 2000, the last Clinton year. The 4 percent figure was the lowest since 1969. Under Bush, unemployment has risen to 4.6 percent.

Job increases under Clinton averaged a remarkable 2.8 million a year, while under Bush, the average increase has been a half million.

There is more. Under Clinton the poverty rate fell from 15 percent to 11 percent, the lowest since 1974; under Bush it has increased to 13 percent. Gross domestic product, after adjustment for inflation, grew almost 4 percent a year under Clinton and slightly more than 2 percent under Bush.

These are all simple facts. And they have affected Americans like you and me and our children.

Did Clinton have some good luck? You bet he did. Clinton was inaugurated just as the economy was coming out of a recession and after every recession the economy benefits from a period of expansion. And he was lucky because starting in 1996 productivity leaped forward, helping to extend the expansion and strong productivity growth is usually more dependent on long-term scientific and technological advances than on wise economic policies.

While Clinton was lucky, he also developed smart, effective policies. His biggest policy success was his enforcement of strict discipline on the federal budget.

In 1992, just before Clinton entered office, the budget deficit was $290 billion, almost 5 percent of GDP. As Bob Woodward recounts in "The Agenda," Clinton became convinced that to reverse the trend toward ever-increasing deficits, he must forget about the middle-class tax cuts he had promised in his campaign and push Congress to raise taxes. He spent much political capital doing precisely that, and he went further by reducing federal spending on popular economic programs.

By the last year of his presidency, he had turned the $290 billion deficit into a surplus of $236 billion, the largest in U.S. history.

By doing this, Clinton fostered rapid growth in net national savings and investment. When the government eliminates budget deficits and starts running surpluses, then government, like the private sector, contributes to total national savings. So you would expect Clinton's budget surpluses to lead to higher national savings. And that is exactly what happened: in 1992, net savings in the U.S. economy were only 3 percent of our gross national income, while by 2000 they amounted to 6 percent.

Savings are used to finance investment and as savings rose during the 1990s, so did investment. Net domestic investment, adjusted for inflation, rose from $354 billion in 1992 to $852 billion in 2000 an increase of 140 percent. That investment helped increase productivity, GDP, and employment. The economic expansion of 1991-2001 was the longest ever recorded, starting with the 1850s.

Admittedly, the lackluster performance of the economy under George Bush is due partly to bad luck. When Bush was inaugurated, the boom years of the Clinton presidency finally were coming to an end, and a recession began just a few months later. But Bush has enjoyed some good luck too: productivity has grown even more rapidly during Bush's presidency than during Clinton's.

In sharp contrast to Clinton's budget discipline, Bush has treated the federal budget like a boy treats a cookie jar: forget about filling it, just reach for more cookies. His huge tax cuts reduced federal revenues, while he has permitted federal government spending of all types to surge.

Military spending rose mainly because Bush began an unnecessary and very expensive (as well as bloody) war in Iraq. Non-military spending also rose. My father, a loyal Republican, would have been amazed to learn that a Republican Congress, in only five years, passed spending bills allowing a 48 percent increase in federal nonmilitary spending and that a Republican president failed to veto even one of these bills!

The Bush policies converted Clinton's final budget surplus of $236 billion into the current budget deficit of $260 billion. As deficits rose, net national savings fell from 6 percent to the current 2 percent of gross national income, while net domestic investment, after the Clinton-era increase of 140 percent, has actually declined!

Bush's deficits have effectively crowded out investment in our economy. No wonder GDP growth has been sluggish.

The outstanding performance of the U.S. economy during the Clinton presidency was due partly to good luck and partly to farsighted, disciplined budget policies. The far inferior performance under Bush has been due partly to a mixture of good and bad luck and partly to irresponsible tax cuts, out-of-control federal spending and soaring budget deficits. We now are paying for the Bush policies with declining net investment, sluggish growth in GDP and employment, and higher poverty rates.

Edwin Dean, a seasonal resident of Vinalhaven, writes monthly about economic issues.

Bush the typical Republican

With his incessant talk of cutting taxes, reducing the size of government, and creating an "ownership society," George W. Bush would be the prototypical Republican even if he weren't president. Therefore, it's useful to see how his policies have failed the standard of fiscal responsibility.

From the LA Times, 12/17/04:

JONATHAN CHAIT

Still Crazy After All These Years

Bush's tax cut didn't work, won't work.

Not having listened to the entire thing, I can't say for sure that every single word uttered at the White House economic conference this past week was nonsensical. But I do know that when I tuned in Wednesday morning, it was only a matter of seconds before I was treated to a piece of pure hokum.

It was conservative economist Martin Feldstein giving his familiar spiel on taxes. Current tax rates, he said, "create bad incentives which slow down the rate of growth of the economy and hurt the standard of living." The point of Feldstein's lecture was that President Bush's tax cuts had made an enormous contribution to economic growth and, if we're not fully satisfied with the results, we ought to cut taxes yet again.

Feldstein's theory reflects the basic underpinning of Bush's economic agenda. The theory is that tax rates exert an enormous influence over people's (and especially rich people's) willingness to work hard and take risks. According to this view, countless potential entrepreneurs and innovators haven't bothered trying to get rich because of high taxes.

The corollary to this theory holds that tax cuts stimulate so much economic growth that they reduce tax revenue far less than conventional economists assume. Alas, the theory has failed every empirical test.

Feldstein's cohorts at the conference were polite enough not to bring up his influential prediction about the 2001 Bush tax cut. When Bush took office, if you recall, moderates prudently argued for using most of the $5.6-trillion-over-10-years budget surplus to pay down the national debt. Bush, however, insisted his tax cut was small enough that even afterward there would be enough left over to pay off the debt and keep a trillion-dollar "contingency fund."

To persuade skeptical tightwads, the administration trotted out Feldstein, who made essentially the same argument he made Wednesday. When tax rates go down, he explained, taxpayers "work harder and take more of their compensation in taxable form." Therefore, "the true cost of reducing the tax rates is likely to be substantially smaller than the costs projected in the official estimates."

As it turned out, the true cost ended up being substantially larger than the estimates. In fact, income tax revenues crashed through the floor, dropping to their lowest level as a percentage of the economy since 1942.

Frankly, it's amazing that anybody listened to Feldstein even then because he had made an equally bumbling prediction eight years before. In 1993, when Bill Clinton raised the top tax rate, Feldstein argued that because high-income workers are so sensitive to tax rates, they would dramatically change their behavior. Clinton's plan, he wrote, "reflects a fundamentally incorrect view of how taxes affect individual behavior." In another column, he thundered that "there is no possibility that the Clinton plan will produce the deficit reduction that it projects."

No possibility! Well, in case anybody has forgotten, the deficit actually dropped far more than anybody projected. Income tax revenue shot up through the ceiling. It's as if there was an actual invisible hand guiding the economy, and it grabbed Feldstein by the collar and screamed, "You're utterly, completely wrong, you fool!"

Feldstein's defenders would claim he just got unlucky twice in a row: Clinton's tax hike happened to precede a huge boom, and Bush's tax cut happened to coincide with a major slowdown. But revenue grew under Clinton and shrank under Bush, far more than could be accounted for by growth alone.

And, anyway, even if that excuse were right, it undermines Feldstein's point. Feldstein and his conservative allies argue that upper-bracket tax-rate levels are crucial to economic health. But history shows that, at the very least, many other factors have a greater effect on economic growth. So accepting large deficits for the sake of tax cuts makes no sense. This history also suggests that it's Feldstein who has a "fundamentally incorrect view of how taxes affect individual behavior."

And yet here is Feldstein today, dispensing his economic wisdom once again before the most powerful people in the country. Imagine if one man had designed the Titanic and the Hindenburg, and then was put in charge of the space program.

In a way, Feldstein's no worse than any of the other conservatives who made laughable claims on behalf of Bush's economic policies. That's exactly why the administration felt no shame in trotting him out once more. Anybody unprepared to make a fool of himself wouldn't appear at that conference in the first place.

From the NY Times:

OP-ED COLUMNIST

Deficits and Deceit

By PAUL KRUGMAN

Published: March 4, 2005

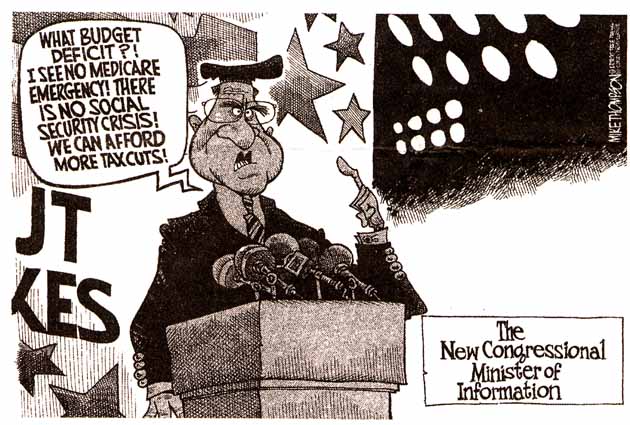

Four years ago, Alan Greenspan urged Congress to cut taxes, asserting that the federal government was in imminent danger of paying off too much debt.

On Wednesday the Fed chairman warned Congress of the opposite fiscal danger: he asserted that there would be large budget deficits for the foreseeable future, leading to an unsustainable rise in federal debt. But he counseled against reversing the tax cuts, calling instead for cuts in Social Security, Medicare and Medicaid.

Does anyone still take Mr. Greenspan's pose as a nonpartisan font of wisdom seriously?

When Mr. Greenspan made his contorted argument for tax cuts back in 2001, his reputation made it hard for many observers to admit the obvious: he was mainly looking for some way to do the Bush administration a political favor. But there's no reason to be taken in by his equally weak, contorted argument against reversing those cuts today.

To put Mr. Greenspan's game of fiscal three-card monte in perspective, remember that the push for Social Security privatization is only part of the right's strategy for dismantling the New Deal and the Great Society. The other big piece of that strategy is the use of tax cuts to "starve the beast."

Until the 1970's conservatives tended to be open about their disdain for Social Security and Medicare. But honesty was bad politics, because voters value those programs.

So conservative intellectuals proposed a bait-and-switch strategy: First, advocate tax cuts, using whatever tactics you think may work -- supply-side economics, inflated budget projections, whatever. Then use the resulting deficits to argue for slashing government spending.

And that's the story of the last four years. In 2001, President Bush and Mr. Greenspan justified tax cuts with sunny predictions that the budget would remain comfortably in surplus. But Mr. Bush's advisers knew that the tax cuts would probably cause budget problems, and welcomed the prospect.

In fact, Mr. Bush celebrated the budget's initial slide into deficit. In the summer of 2001 he called plunging federal revenue "incredibly positive news" because it would "put a straitjacket" on federal spending.

To keep that straitjacket on, however, those who sold tax cuts with the assurance that they were easily affordable must convince the public that the cuts can't be reversed now that those assurances have proved false. And Mr. Greenspan has once again tried to come to the president's aid, insisting this week that we should deal with deficits "primarily, if not wholly," by slashing Social Security and Medicare because tax increases would "pose significant risks to economic growth."

Really? America prospered for half a century under a level of federal taxes higher than the one we face today. According to the administration's own estimates, Mr. Bush's second term will see the lowest tax take as a percentage of G.D.P. since the Truman administration. And don't forget that President Clinton's 1993 tax increase ushered in an economic boom. Why, exactly, are tax increases out of the question?

O.K., enough about Mr. Greenspan. The real news is the growing evidence that the political theory behind the Bush tax cuts was as wrong as the economic theory.

According to starve-the-beast doctrine, right-wing politicians can use the big deficits generated by tax cuts as an excuse to slash social insurance programs. Mr. Bush's advisers thought that it would prove especially easy to sell benefit cuts in the context of Social Security privatization because the president could pretend that a plan that sharply cut benefits would actually be good for workers.

But the theory isn't working. As soon as voters heard that privatization would involve benefit cuts, support for Social Security "reform" plunged. Another sign of the theory's falsity: across the nation, Republican governors, finding that voters really want adequate public services, are talking about tax increases.

The best bet now is that Mr. Bush will manage to make the poor suffer, but fail to make a dent in the great middle-class entitlement programs.

And the consequence of the failure of the starve-the-beast theory is a looming fiscal crisis -- Mr. Greenspan isn't wrong about that. The middle class won't give up programs that are essential to its financial security; the right won't give up tax cuts that it sold on false pretenses. The only question now is when foreign investors, who have financed our deficits so far, will decide to pull the plug.

And from the LA Times:

Jonathan Chait: Bankrupted by voodoo economics

While Republicans tax-cut and spend, research shows increases lead to reduced government.

May 14, 2006

IF YOU REMEMBER the 2000 election, you probably remember President Bush's warning about why we needed to cut taxes: If we did not return the surplus to the taxpayers, Washington would spend it. Well, we all know what happened next. Bush returned the surplus to taxpayers and Washington spent the money anyway.

Conservatives have a number of analogies to explain why tax cuts will lead to spending restraint: Cut your child's allowance. Starve the beast. But the analogies are all wrong. The child has a credit card. The beast has a private meat locker. Washington can spend whatever it wants, regardless of how much it taxes.

The right has been congenitally unable or unwilling to grasp this lesson. Last week, though, there was a faint glimmer of recognition. William Niskanen, chairman of the fervently anti-government Cato Institute, did a calculation showing that, since 1981, every $1 in tax cuts tends to produce 15 cents of extra spending. Likewise, every $1 of tax hikes tends to reduce spending by 15 cents. The notion that tax cuts cause spending to dry up, or that tax hikes encourage more spending, is not just wrong, it's completely backward.

Now, Niskanen is not the first policy wonk to discover this correlation. Four years ago, Richard Kogan of the liberal Center on Budget and Policy Priorities discovered the same thing. I wrote about it in the New Republic and nobody paid any attention.

But Niskanen's finding is getting some attention. Moderate libertarian Jonathan Rauch wrote about it in the Atlantic, and a Washington Post columnist picked it up from there.

You'd think conservatives would pay some attention to a study that empirically demolishes one of the central underpinnings of their domestic policy. Indeed, my fellow columnist, Jonah Goldberg, wrote on National Review's blog last Monday that "conservatives are going to have to respond to Jonathan Rauch's argument in the new Atlantic."

Of course, no response ensued. Indeed, the next day, National Review was on its merry way, editorializing for more tax cuts, as if Niskanen's study didn't exist.

The curious thing is why conservatives persist in supporting a strategy that is demonstrably counterproductive to their stated goal of shrinking government. The answer can be found in the same entry by Goldberg. He proceeded to write: "There are others better qualified to deal with the economic issues. But if tax increases can be demonstrated to shrink government in some significant way, I'm certainly open to them."

Indeed, there is plentiful evidence that tax hikes can slow spending. There is a sizable chunk of the Democratic Party that is willing to inflict pain on their constituents in the form of spending cuts as long as the rich bear some of the burden in the form of higher taxes. In 1982, 1983, 1990 and 1993, Democrats in large numbers voted for budgets that ratcheted back spending and raised taxes.

In 1995, many Democrats offered to cut spending and balance the budget. But Newt Gingrich and the Republicans quashed that move by insisting on huge tax cuts too.

The insistence on tax cuts tends to weaken fiscal restraint all around. Having tended to the rich with tax cuts, Bush had to buy off enough voters with spending hikes to win reelection.

Most conservatives are like Goldberg they want to shrink spending. But most conservatives, also like Goldberg, tend to think that "others are better qualified" to make those decisions. Conservative opinion outlets tend to subcontract out their economic thinking to a handful of polemicists, and virtually all of them are committed advocates of supply-side economics. They're theologically committed to tax cuts and don't really care about spending cuts. They studiously ignore any evidence that weakens their case which is to say, most of the evidence.

So, basically, you have a handful of supply-siders leading the rest of the conservatives around by the nose. The conservatives could cut a deal with the Democrats to tighten spending and taxes, but the anti-tax nuts are the ones who set policy for the movement.

It's funny. Almost all the conservatives, including Goldberg, are furious at Bush for raising spending. But it hasn't occurred to them to question the dogma of the voodoo economists who led them into this mess in the first place.

Bush loves big government

With Bush's tax policies failing to achieve his stated aims, what are the actual results? From the LA Times, 2/8/05:

NEWS ANALYSIS

President Putting 'Big' Back in Government

By Janet Hook, Times Staff Writer

WASHINGTON Even as President Bush proposes significant cuts in healthcare, farm subsidies and other domestic programs, his new budget makes one thing clear about the legacy of his first term in the White House: The era of big government is back.

Bush's $2.57-trillion budget for 2006, if approved by Congress, would be more than a third bigger than the 2001 budget he inherited four years ago. It is a monument to how much Republicans' guiding fiscal philosophy has changed over the 10 years since the GOP's Contract With America called for a balanced budget and abolition of entire Cabinet agencies.

No longer are Republicans arguing with Democrats about whether government should be big or small. Instead, they are at odds over what kind of big government the U.S. should have.

"This Republican Party is much less fiscally conservative than the one that took Congress 10 years ago," said Brian M. Riedl, a budget analyst at the Heritage Foundation, a conservative research and policy center in Washington. "That Congress believed in eliminating entire departments that weren't justified. You don't hear that these days. I wish we did."

Bush is releasing his budget at a time when many fiscal conservatives in his party are dismayed by how much he has allowed federal spending and the deficit to rise during his first term in the White House. This vocal but outnumbered faction of the GOP was furious when, in 2003, Bush signed a big increase in federal farm subsidies and pushed Congress to expand Medicare to cover prescription drug benefits.

In this budget, Bush has moved to placate those critics by restating his promise to cut the deficit in half by 2009; by pledging to abolish or cut spending for 150 programs; and by taking on fast-growing entitlements such as farm subsidies and Medicaid.

But many analysts view those promises with skepticism because, they say, Bush in his first term had a disappointing record of confronting Congress on popular spending programs. He has never vetoed a bill, making him the first president so restrained since James Garfield, who was shot to death after less than a year in office.

"This is a promise in which his position so far is not credible," said William A. Niskanen, chairman of the Cato Institute, a libertarian think tank, and a former economic advisor to President Reagan. "President Bush also promised to reduce the deficit in half last year, but it went up $15 billion."

Much of the deficit growth during Bush's first term was the result of four rounds of tax cuts and increases in defense and domestic security programs after the Sept. 11 attacks. Bush and fellow Republicans have argued for the last three years that eliminating the deficit had to take a back seat in the budget because the country was at war and the economy was sagging. Now that the economy has improved and Iraq has elected its own government, the pressure is on Bush to combat the deficit.

However, Bush's budget projections likely understate future deficits as they do not include the full costs of three priorities at the core of what he seeks as his second-term legacy: ongoing military operations in Iraq and Afghanistan, making his 2001 and 2003 tax cuts permanent, and overhauling Social Security.

And even where Bush is pushing to reduce spending, analysts say, there may be less there than meets the eye.

Bush is right in saying that his budget is "very tight" but only for domestic discretionary programs, which are the ones that Congress controls with annual appropriations bills. That category makes up about 17% of the budget. Those programs would be cut by 1%. But defense would get an increase of almost 5% bringing its overall growth to 41% since 2001. Spending for domestic security would grow nearly 7% over last year. Medicare is on track to increase by $50 billion, about 17%.

Bush says those selective increases and cuts amount to "setting priorities." Democrats say they confirm their worst fears that the deficit is being used only as a pretext for cutting programs favored by Democrats and their constituencies such as Amtrak trains, which are particularly popular along the East Coast; Medicaid programs, which serve the poor; and job training programs, which are backed by labor unions.

"What this president is doing is what Republican presidents and Congresses have been doing for a generation: using the budget deficit to justify the destruction of programs the American people trust and rely on," said John Lawrence, Democratic staff director of the House Committee on Education and the Workforce.

Democrats may not be alone in resisting Bush's domestic spending cuts. Republicans have joined them in blocking past efforts to abolish popular programs. Of the 65 programs Bush proposed eliminating last year, Congress ultimately killed four.

Republicans are already squawking.

"Programs like Amtrak, beach replenishment and education funding have so much support in Congress that I believe the funding will be restored," said Rep. Michael N. Castle (R-Del.).

In defending his budget-cutting proposals, Bush is offering a rationale far different from the root-and-branch, antigovernment rhetoric Republicans used 10 years ago. Bush argues that his cuts are driven by a managerial interest in eliminating waste, duplication and ineffective programs.

"I fully understand that sometimes it's hard to eliminate a program that sounds good," Bush said Monday. "The important question that needs to be asked for all constituencies is whether or not the programs achieve a certain result."

That is a far cry from the rhetoric Republicans used in 1995, when their government-slashing fervor was exemplified by former Rep. Bob Livingston (R-La.), the House Appropriations Committee chairman who brought a machete to his first panel meeting to dramatize his commitment to cutting programs. That year, the Republican-controlled Congress abolished 270 programs. They cut discretionary spending by $12 billion the only year since Republicans took control of Congress that spending did not grow.

Republicans' commitment to eliminating the deficit, a cornerstone of the Contract With America, also seems a thing of the past. Party members now argue that the deficit although it is a record in absolute numbers is manageable because, when measured as a share of the economy, it is not as large as Reagan's 1983 deficit.

But Stanley E. Collender, a budget analyst with Financial Dynamics, a business communications firm in Washington, said that amounted to "using the budget failure of one Republican to make the large deficits of another appear to be less troubling.

"President Bush would never admit this, but he has transformed the party into the party of permanent big deficits," he said.

A key question is whether that prospect spooks Republicans into taking more aggressive steps to reduce the deficit and curb spending.

Ironically, the initiatives that might suffer are the cornerstones of Bush's second-term agenda. Some Republicans already are balking at his Social Security overhaul because of its high transition costs. And even some Bush loyalists including Sen. Pete V. Domenici (R-N.M.), former chairman of the Senate Budget Committee are having second thoughts about Bush's proposal to make his tax cuts permanent.

Said Steve Bell, Domenici's chief of staff: "These deficits are serious business."

From the Detroit News:

Saturday, July 15, 2006

Froma Harrop:

Why won't Democrats brag about their fiscal discipline?

As for White House comparisons, there's no contest. The current Republican administration leaves its Democratic predecessor in the dust for both amounts spent and money wasted. Bush is the biggest spender since Lyndon Johnson, according to the Cato Institute. In domestic discretionary spending (which doesn't include defense or entitlements), Bush has Johnson beat. By contrast, Bill Clinton stands as a paragon of restraint. Domestic discretionary spending jumped an average 8 percent a year in Bush's first term, versus only 2.5 percent annually in Clinton's eight years.

Many conservatives are amazed that Democrats haven't made more hay of their superior record in containing the size of government. The Democrats' dilemma is that they are not philosophically opposed to expanded government, even if in practice they have shown far more spending discipline.

Democrats really ought to brag about their Clintonian track record. Not only did they keep government growth in check, but they paid its bills the old-fashioned way, with tax revenues. That's what fiscal rectitude is all about. And it shines next to the Bush administration's disgraceful habit of borrowing on the backs of future generations.

Even more important, Democrats have spent the taxpayers' money with greater care. The reason, in part, is that Democrats don't maintain a childlike faith in the good intentions and can-do of the private sector. They believe in regulating these guys and that government can do some things better than can business.

The Bush administration likes to send big checks and a have-a-nice-day to private contractors, who then do as they please. Our M.B.A. president seems to forget that he is supposed to represent the taxpayers in these transactions, not the business interests.

Sloppy oversight has led to a plague of overbilling, incompetence and shoddy work. The gruesome details are just now emerging from at least two spending ratholes the hurricane-relief efforts and the so-called rebuilding of Iraq.

About a quarter of the disaster aid for victims of Hurricanes Katrina and Rita up to $1.4 billion has been stolen, according to the Government Accountability Office. We've read about the French champagne, soft-core porn and Caribbean vacation. But perhaps the biggest waste of all has been the funds spent on the fraud-prevention system at the Federal Emergency Management Agency. The "watchdogs" over at FEMA did not even notice that multiple requests for aid were being filed under the same Social Security numbers. That would never have gotten past MasterCard.

In Iraq, hundreds of millions of taxpayer dollars for rebuilding seem to have disappeared, according to U.S. audits. The Wall Street Journal reports that not only are corrupt contractors suspected of taking the money, but also U.S. and Iraqi government officials. Taxpayers should know that Washington has set aside over $21 billion for the reconstruction of Iraq.

Republicans used to accuse Democrats of "throwing money at problems." The Bush administration not only throws money at problems; it misses them.

Republicans love big government

From the Washington Post:

In Congress, the GOP Embraces Its Spending Side

By Jonathan Weisman

Washington Post Staff Writer

Thursday, August 4, 2005; A01

GOP leaders this week sent House Republicans home for the summer with some political tips, helpfully laid out in 12 "Ideas for August Recess Events." Drop by a military reserve center to highlight increased benefits, the talking points suggest. Visit a bridge or highway that will receive additional funding, or talk up the new prescription drug benefit for seniors.

Having skirted budget restraints and approved nearly $300 billion in new spending and tax breaks before leaving town, Republican lawmakers are now determined to claim full credit for the congressional spending. Far from shying away from their accomplishments, lawmakers are embracing the pork, including graffiti eradication in the Bronx, $277 million in road projects for Speaker J. Dennis Hastert (R-Ill.), and a $200,000 deer-avoidance system in New York.

When the year started, President Bush made spending restraint a mantra, laying out an austere budget that would freeze non-security discretionary spending for five years and setting firm cost limits on transportation and energy bills. But now, as Congress fills in the details of the budget plan, there is little interest in making deep cuts and enormous pressure to spend.

Lawmakers have seen little to fear from a political backlash, some acknowledge, and Bush has yet to wield his veto pen. In fact, the White House has proved itself largely unable to overcome the institutional forces that have long driven lawmakers to ply their parochial interests with cash.

When lawmakers return in the fall, they are almost certain to vote for more tax cuts. They also will vote on a huge new defense spending bill. But proposals for cutting entitlement programs including Medicaid have yet to pick up much support.

"If you look at fiscal conservatism these days, it's in a sorry state," said Rep. Jeff Flake (R-Ariz.), one of only eight House members to vote against the $286.5 billion transportation bill that was passed the day before the recess. "Republicans don't even pretend anymore."

Last week, Congress approved transportation and energy bills that burst through the president's cost limits. Annual spending bills are inching above caps set by Congress itself in its budget plan for 2006. And a massive water projects bill passed by the House last month authorizes spending that would exceed current levels by 173 percent.

"You have to be courageous to not spend money," said Sen. Tom Coburn (R-Okla.), "and we don't have many people who have that courage."

Indeed, Congress has exceeded the allocations or assumptions in its budget resolution four times and the year's legislative work is far from complete. According to the nonpartisan Committee for a Responsible Federal Budget, those budget violations have raised spending through 2010 by roughly $2.2 billion above Congress's limits and tacked $115 billion onto the federal budget deficit through the end of decade, including $33 billion in 2006 alone.

That $33 billion may be tantamount to a rounding error in a $2.6 trillion budget, but it is 10 percent of the $333 billion budget deficit the White House has forecast for the fiscal year that ends Sept. 30.

"There's a rising level of frustration with the disconnect between where the vast majority of conservatives are in this country and how Congress is behaving," said former representative Pat Toomey (R-Pa.), whose Club for Growth political action committee finances the campaigns of conservative candidates. "There's going to be a wake-up call sooner or later."

For now, Congress and the White House are locked in a pattern of skirting their own constraints. In 2004, Bush demanded that no highway bill exceed $256 billion. Under pressure, he increased his limit to $284 billion this year. Congress responded with a five-year, $286.5 billion measure, but even that figure may be deceptive, Flake warned. The bill actually authorizes expenditures of $295 billion but assumes that, on the last day of the bill's life, Congress will rescind $8.5 billion in unused funds.

"Nobody believes that's going to happen," Flake said. "It's frankly a pretty transparent gimmick."

Bush set a firm cost limit of $6.7 billion for tax breaks in the energy bill. Congress then approved breaks worth $11.5 billion over 10 years in an energy bill that will cost $12.3 billion overall. In late June, the White House hastily requested an additional $975 million to finance unanticipated veterans' health care costs for 2005. The Senate responded with $1.5 billion.

So far, Congress has completed only two of 13 annual spending bills, but both one primarily financing the Interior Department, the other funding Congress busted lawmakers' prescribed spending caps, by $134 million. The House and Senate have passed spending plans for the departments of Health and Human Services, Labor, and Education that exceed Bush's request by billions.

And on July 14, the House overwhelmingly approved a major water bill that authorizes projects worth $10.3 billion over 10 years $4.4 billion in the first five. In 2000, Congress approved a similar act worth a fraction of that, $1.6 billion over five years.

To fiscal conservatives, it is not just the total cost of the bills but also their content. Covering 1,752 pages, the highway bill is the most expensive public works legislation in U.S. history, complete with 6,376 earmarked projects, according to the watchdog group Taxpayers for Common Sense. Kern County, Calif., home of powerful House Ways and Means Chairman Committee Chairman Bill Thomas (R), snagged $722 million in projects, or nearly $1,000 per person. Los Angeles County, with clogged highways and 10 million people, will receive barely $60 per resident.

Even before the bill was signed, Kane County, Ill., leaders showed their faith in Speaker Hastert last week by unveiling blueprints for a $120 million bridge, to be financed largely by the federal government.

This week, House GOP leaders sent their legislators 52 pages of talking points, some addressing fiscal discipline, others touting the spending. The final page lays out 12 "Ideas for August Recess Events," none of which trumpets small government.

Sean M. Spicer, a spokesman for House Republican Conference Chairman Deborah Pryce (Ohio), said lawmakers have nothing to be ashamed of. House appropriators have recommended that 101 federal programs be terminated, at a savings of $4.6 billion. And House members have pushed their Senate colleagues to stay pretty close to the budget limits.

The highway bill means jobs, he said. The energy bill addresses a pressing national interest, and no one is going to complain about additional funding for veterans' health care, he added.

"With Congress unable to keep its pocketbook pocketed, it would be nice if President Bush could be counted upon to cast his first vetoes on bills so richly deserving of them," the editors of the conservative National Review wrote yesterday.

But administration officials counter that the bills could have been far worse. An energy bill worked out by House and Senate negotiators in 2003 would have cost more than twice as much as the current version.

"It should be signed," said Deputy Energy Secretary Clay Sell. "It's the best energy bill that can be passed."

The highway bill initially proposed in the House would have cost $88 billion more than the final version.

"The president's insistence on spending restraint resulted in both the highway and energy bills coming in far less than originally proposed by Congress," said Scott Milburn, spokesman for the White House budget office.

© 2005 The Washington Post Company

Republicans spend like there's no tomorrow

If elections are on the line, they vote to spend. This alone proves their "small government" beliefs are hypocritical.

From the NY Times:

News Analysis

Politics Drives a Senate Spending Spree

By CARL HULSE

Published: March 18, 2006

WASHINGTON, March 17 The largess demonstrated by the Senate in padding its budget with billions of dollars in additional spending this week showed that lawmakers are no different from many of their constituents: they don't mind pulling out the charge card when money is tight.

Just hours after opening a new line of credit through an increase in the federal debt limit, the Senate splurged on a bevy of popular programs before approving a spending plan that was as much a political document as an economic one, its fine print geared to the coming elections.

Forced to choose between calls for renewed austerity and demands for more money, many Republicans joined Democrats in reaching deeper into the Treasury, leaving the party's push for new fiscal restraint in tatters.

Some of their colleagues said it was an open-and-shut case of nervous politicians ducking a tough spending stance to avoid starring in negative campaign commercials. Republicans in some of this year's tightest races Conrad Burns of Montana, Mike DeWine of Ohio, Rick Santorum of Pennsylvania, Jim Talent of Missouri and Lincoln Chafee of Rhode Island all backed the chief budget-busting provision as they endorsed an extra $7 billion for medical research, education and worker safety.

Lawmakers, analysts and others said the Senate's reluctance to clamp down on spending was a natural result of an approach that fails to recognize a sharply changed reality. In some respects, the administration and Congress act as if the surplus that greeted President Bush when he checked into the White House is still in the bank, rather than recognizing that whatever windfall was available then was eaten up and more by tax cuts.

The reality is that the cuts, plus two wars, new domestic security needs, natural disasters and a big expansion of Medicare have left the government's account badly overdrawn with no prospect of getting it back in balance anytime soon.

The criticisms set out by many Democrats that no real progress can be made in setting the nation's finances right until Congress proves willing to revisit the tax cuts and that the nation is failing to invest sufficiently in addressing its economic and social ills do not receive much of a hearing in a Washington where Republicans are in charge.

"I think the critical flaw is the failure to adjust fiscal policy in the face of new circumstances," said Robert L. Bixby, executive director of the Concord Coalition, a bipartisan group that advocates reducing the deficit through spending cuts and tax increases.

Mr. Bixby and others say the Republican-controlled Congress and the Bush administration have shown a near total disregard for fiscal discipline, running up new debt.

"The problem we have had on the budget all along is a lack of adult supervision on the part of the White House," said Bruce Bartlett, an economist and author of a new book critical of Mr. Bush's economic record. "You can't blame members of Congress for looking out for their parochial interests. It is the president's responsibility to look out for the national interest."

With the president's influence on Capitol Hill slipping along with his poll numbers, it is unclear how much authority Mr. Bush could exert over lawmakers regardless. Senate Republicans showed no hesitation about bursting through the spending ceiling he set, adding more than $16 billion after eliminating some of his cuts.

And while the House, which was considering $92 billion in emergency war spending and hurricane aid, rejected most efforts to increase that total, lawmakers did buy a few extras, including $50 million more for peacekeeping in Darfur.

Almost lost in all the budget and spending activity was that House and Senate negotiators continue to try to hammer out an agreement for new tax cuts that could cost an additional $70 billion over five years.

If Republicans in the Senate were motivated by a political calculation that this was not the time to close the fiscal taps, much less cut more deeply into domestic spending, they risked what some conservatives suggested could be a backlash from the right. Many strategists have warned Republicans that their core conservative supporters are demoralized by what they see as the unchecked growth of government.

John Kasich, a former Republican chairman of the House Budget Committee and devotee of balanced budgets who is now an investment adviser and author, said much of Washington had surrendered to the political impulse to please various voter groups with unbridled spending."

Republican leaders see it a bit differently. They point to nearly $40 billion in savings from social insurance programs they produced last year, an effort that took a tremendous amount of political effort. And an across-the-board cut shaved about $8 billion from current agency budgets.

They say they intend to hold spending for most agencies outside of the military and domestic security under this year's tight limits and will try to erase some of the Senate spending additions in negotiations with the House.

To do so, they will have to get around Senator Arlen Specter, Republican of Pennsylvania, who clamored for the extra $7 billion. Mr. Specter said that spending constraints had cut too deeply into health and education programs and that there was a strong show of support for the money a majority of Republicans backed it.

Republicans also say they see a proposed line-item veto and new restrictions on pet projects as part of a rehabilitation program to kick their spending habit. While those initiatives may end some suspect practices, most see the savings as chump change in an era of $350 billion annual deficits and $9 trillion in total debt.

Serious fiscal worriers believe the only true fix can come from a bipartisan meeting of the minds that would put all federal programs on the table along with consideration of both spending cuts and tax increases.

"I've concluded this job is so big it can only be done if the two parties work together," said Senator Kent Conrad of North Dakota, the senior Democrat on the Budget Committee.

But Mr. Conrad acknowledged that nothing substantive could get done in the short term, with both parties girding for November. As the Senate deliberations show, frugality is not an election-year budget value.

Tax cuts don't cut spending

From the LA Times, 6/11/06:

JONATHAN CHAIT

The tax-cut follies: Part II

A FEW WEEKS ago, I wrote a column about a paper that decimated the conservative worldview. The study, by William Niskanen of the Cato Institute, found that the conservative "starve the beast" strategy does not work. Indeed, since 1981, he found that tax cuts tend to produce more spending, while tax hikes produce less.

I wrote that it would be interesting to see how conservatives reacted to having the factual basis for their entire domestic strategy exposed as a fraud. And it is interesting because "starve the beast" is so central to the GOP approach to governing and because the reaction is a case study in how the conservative movement reacts when its views are disproved.

Well, the right has had sufficient time to formulate its response. The results aren't very impressive.

Out of the reams of conservative commentary published over the last month, I have found exactly two items reacting to Niskanen's research. Given his paper's devastating implications, the response is quantitatively and qualitatively pathetic.

The first is an Op-Ed column by Nick Schulz in National Review Online. Schulz found Niskanen's finding a big puzzle. "Why would tax cuts prompt more spending?" he asks. "The only explanation so far comes from Niskanen himself," who hypothesizes that tax cuts make government cheaper, so voters want more of it.

The only explanation? My column, which Schulz cites but apparently has not read, offered a different and (if I do say so myself) convincing explanation. I argued that Democrats are willing to inflict pain on constituents in the form of spending cuts in order to balance the budget but not in order to give tax cuts to the rich. So, when Republicans agree to raise taxes, large numbers of Democrats will join them to cut spending. This happened in 1982, '83 and '90. Democrats did it themselves in '93.

But when Republicans cut taxes, Democrats refuse to give them cover to make politically unpopular spending cuts. Republicans feel obliged to prove to voters that tax cuts aren't hurting their cherished programs. The latest case in point: the Bush tax cuts resulted in a Bush spending boom.

It's a clear explanation, amply supported by recent history. Schulz pretends it doesn't exist and instead argues that Niskanen's research shows that Americans don't want higher tax rates, so that will pose a problem for liberals as the cost of entitlement programs rise. I'm not sure what this has to do with the point at hand. It certainly doesn't explain why conservatives should persist in a demonstrably failed strategy.

The only other response I could find comes in the form of a single-paragraph mini-editorial from National Review. The editors have three points. First, they argue that tax cuts might "cause spending cuts after a few years." For example, they posit that Ronald Reagan's tax cuts may have "helped doom Bill Clinton's" healthcare plan.

This might be persuasive if the Reagan deficits had stopped Clinton from trying to reform healthcare. But that's the opposite of the truth Clinton pursued healthcare in part because of the deficits. Reform was an attempt to contain rising healthcare costs that were bankrupting government. And it failed not because of tax cuts and deficit pressure but because healthcare providers opposed it and helped convince the public that it would threaten their care.

Second, they note the "economic case" for cutting marginal tax rates. But no economic model shows that long-term tax cuts without spending cuts help the economy. Even the most conservative economists favoring tax cuts predicate their support on spending cuts to go with them. Once you prove that tax cuts will raise rather than lower spending, that approach goes out the window.

Finally, National Review's editors sniff that Niskanen's paper isn't that big a deal because it "would only prove that there is no easy way to get a welfare state to reduce spending." Huh? There is an easy way: Make a deal with moderate Democrats to raise taxes and cut spending! That's exactly what Niskanen found and what the last two decades have shown can succeed.

But it's also an approach the conservative movement fervently rejects. It's said that the definition of insanity is doing the same thing over and over and expecting a different result. So do conservatives really care about cutting spending, or are they all insane?

Related links

Schwarzenegger the girlie-man governor

Are taxes "theft"?

Faith in free markets

America's culture wars (economic)

Readers respond

"There are so many holes in your logic it is almost funny."

|

. . . |

|

All material © copyright its original owners, except where noted.

Original text and pictures © copyright 2007 by Robert Schmidt.

Copyrighted material is posted under the Fair Use provision of the Copyright Act,

which allows copying for nonprofit educational uses including criticism and commentary.

Comments sent to the publisher become the property of Blue Corn Comics

and may be used in other postings without permission.