Another Stereotype of the Month entry:

Another Stereotype of the Month entry:

Another Stereotype of the Month entry:

Another Stereotype of the Month entry:

Saturday, July 22, 2006

Posted: July 22, 2006

1:00 a.m. Eastern

By Barb Lindsay and David Yeagley

© 2006

We would like to believe Congress did not intend for non-Indians to be the principal beneficiaries of the Indian Gaming Regulatory Act of 1988, or IGRA. Yet the fact is non-Indian investors, lobbyists, politicians and casino management companies have left behind the poverty-stricken Native American families Congress intended to help. Non-Indians are enriching themselves through IGRA's $22.6 billion a year Indian casino business. Jack Abramoff was the perfect example.

We would like to believe Congress did not intend off-reservation communities to suddenly become convenient casino locations. But, abuse of IGRA provisions has allowed tribes to go "reservation shopping" anywhere they want – anywhere prime gambling facility locations can be found.

The damage being inflicted on small-town America is very real. Communities neighboring the new Indian casino expansions all face devastating effects. The problems are similar in dozens of states across the nation. Major national news investigations have been published, ranging from Time and Forbes to the New York Times and the Wall Street Journal. These reports describe how tribal government actions have caused soil erosion, water shortages, snarled traffic and increased crime. Tribal policies have bankrupted neighboring businesses and forced evictions of elderly homeowners for the sole purpose of casino parking-lot expansion. These effects have dramatically reduced property values in communities that host tribal casinos.

We would like to believe Congress did not intend federal "trust" status of tribally purchased land to enable autonomous (often syndicated) gambling operations to dominate the economy and social character of surrounding communities. But, "sovereign immunity" shelters tribal trust land from taxation and virtually all state laws and local regulation. Tribal leaders and their coercive, out-of-state casino investors are, thus, responsible only to themselves for their actions.

We would like to believe Congress did not intend Indian casinos to adversely affect their surrounding communities. But, tax- and regulation-free casinos destroy local, taxpaying, non-tribal businesses. The lower prices offered by Indian businesses attract non-Indian clientele, thus shrinking state and local tax receipts, and contributing to an addictive behavior that severely strains local social services. (This is especially true when tribes allow 18-year-olds to gamble, as they currently do in California, Washington and a number of other states across America.)

Tribal businesses typically refuse to collect or remit state and local sales taxes (even though the U.S. Supreme Court has ruled four times that tribal businesses are lawfully required to both collect and remit taxes on purchases made by their non-tribal customers). Tribal businesses can therefore significantly undercut the regular price of gasoline, cigarettes and many other retail items. This Indian "tax evasion" is why there is only one non-Indian gas station left in all of upstate New York and the state is facing a $1 billion budget deficit. It's due in large part to the refusal of Indian smoke shops and gas stations to collect New York state sales taxes on cigarettes and gasoline. The same thing is happening in Oklahoma, Wisconsin, Minnesota, Idaho, Nebraska and Washington state. California faces the same threat to its future.

We would like to believe Congress did not intend tribal governments to make political contributions from tax-exempt casino profits and federal taxpayer-funded grants without regard to contribution limits that apply to every other for-profit enterprise. In fact, other sovereign governments (foreign and domestic) cannot contribute to election campaigns. Nor can corporations make federal campaign donations. But, the Federal Election Commission has given a free pass to tribal "nations" (and, indirectly, their non-Indian corporate backers) to influence the policy decisions upon which their gambling monopolies depend.

According to the Federal Election Commission, Indian tribes are now the largest contributors to our election campaigns nationwide, exceeding even the largest labor and teachers' unions. Last year, tribes contributed more to federal election campaigns than the manufacturing and defense industries. And Indian tribes are far and away the largest campaign contributor group in dozens of states, including Washington, Oregon and California. Tribes even use their "government allotment" funds to make federal campaign contributions, in addition to making campaign donations from their tax-exempt tribal casino "corporate" accounts. None of the rest of us can make government or corporate donations to federal races! In California's gubernatorial recall race several years ago, the Agua Caliente gave $2 million and the Santa Rosa Tribe $1 million to Cruz Bustamante, far in excess of the state's $49,500 limit on campaign contributions to a single candidate in a single race.

We would like to believe Congress recognizes that these non-Indian communities aversely affected by Indian operations in fact comprise American citizens – with all civil rights inherent. But Congress appears to have given "tribal sovereignty" a primacy that supersedes American citizenship. This privilege has grown in direct proportion to the growth of casino revenues. The rights of American citizens who are not enrolled members of a casino-owning Indian tribe have shrunk accordingly. Politicians, enticed (and intimidated) by tribal campaign contributions, have allowed a vast expansion of tribal "sovereignty," and the extension of immunities on tax, land-use laws and business regulations. Congress never intended this result.

The lure of a tax-free casino has created a flurry of self-defined tribes, all suddenly rediscovering themselves – with the help of outside billionaires anxious to cash in on the tax-free "Indian" casino. This is the era of the "pop-up" Indian tribe, which doesn't even have to be Indian. A "reservation shopping" industry has blossomed, with well-financed "rainmakers" lined up at the Interior Department's door. They also lurk outside congressional offices, influencing federal policies to expedite tribal recognition and fee-to-trust land conversion decisions. The Abramoff scandal is just one famous, monstrous example of the deceit, fraud and greed recently investigated by the Senate Indian Affairs Committee in a 373-page report written by Republican and Democratic staff.

The result of misconceived sovereignty laws is a "gold rush" of off-reservation Indian casinos across the country, especially in California. There are now 420 tribal casinos up and running in 30 states, with dozens more awaiting approval by federal bureaucrats. This well-intentioned jump-start of the Native American economy has outraged many non-Indian residents in local communities where casinos have already opened. Citizens are greatly alarmed as they see tribes flouting the laws of the land.

Allowing more and more land to be removed from the tax rolls and put into trust status for the purpose of building tribal casinos and other development projects causes hardship to all entities dependent upon taxes derived from property values. The state, county, city, fire districts, law enforcement and school districts are all impoverished. The remaining property owners must, of course, make up the difference through increased taxation to support needed public services. The tribes are acquiring tens of thousands of acres in states across America, and the fee-to-trust process is adversely affecting local citizens as tax rolls diminish with each tribal parcel that is removed and given tax-exempt status.

Yet fault does not lie entirely with the fee-to-trust process or even tribal sovereign immunity. To fault Indians for benefiting from gambling and other dubious propensities of the greater population is simply blaming Indians for the white man's weaknesses.

The blame really lies with politicians who promote gambling and lottery profits as beneficial to the state. They ignore the social costs and instead offer under-funded, ineffective palliatives to gambling addicts. Too few community leaders demand legislative solutions. The traditional American work ethic has been replaced by the fantasy of wealth without labor, without responsibility and without any effort to save money. And buying from Indian businesses has become an irresistible temptation to millions of Americans – all of whom are breaking the law by not paying taxes that are lawfully due.

Meanwhile, state and federal politicians are often too willing to deal with casino promoters for a piece of the action. "Sovereign" tribal gambling operations and their ancillary commercial enterprises remain accountable only to themselves. They too often disdain meaningful responsibility toward surrounding communities, and due to these complicit and unfaithful politicians, our democratic process is lost in a tidal wave of casino cash.

In 2005, tribal casino revenue was $22.6 billion, twice the take of Nevada gaming. Yet, the vast majority of Native Americans do not benefit from IGRA riches. Many Indians have even been dis-enrolled from their tribes by greedy tribal leaders who know that fewer members means a bigger piece of the pie for each. Thus, Indians are also the victims of a well-intentioned congressional act that has been superseded by the Law of Unintended Consequences. Thankfully, Congress is set to vote on long overdue reforms.

Sen. John McCain, R-Ariz., and Rep. Richard Pombo, R-Calif., are currently sponsoring legislation to address some of these critical problems. Before Congress adjourns this year, it is set to vote on S.2078 and H.R. 4893. These two vitally important bills deserve the support of all concerned U.S. citizens. Please contact your two U.S. senators and congressional representative today and urge them to co-sponsor and vote yes on these bills to reform the Indian Gaming Regulatory Act and the flawed fee-to-trust process.

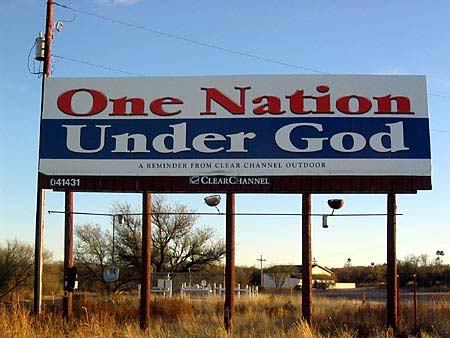

The future of our nation and its democratic process depends upon the action we take now. Our children and grandchildren will live with our decisions. We must support legal reform of our federal government's terribly misguided Indian policies. Shall America be "one nation, indivisible" with equality under the law for all U.S. citizens, as intended by our Founding Fathers, or will we instead allow a greedy American aristocracy to use Indians tribes to crush other Americans, thus degrading the whole country and destroying all respect for Indian people? Shall we allow wealthy American elites to abuse the American people the same way King George III did in 1776, when he incited Indians against the colonists?

Dr. David Yeagley is an enrolled member of the Comanche Nation of Lawton, Okla. He is a musician and scholar, with degrees in music, literature and religion. Yeagley is the founder and president of the Bad Eagle Foundation.

Barb Lindsay is national director and spokeswoman for One Nation United, a nonpartisan, nonprofit umbrella group dedicated to the comprehensive reform of flawed federal Indian policy for the benefit of Indians and non-Indians alike. She is an enrolled member of Western Cherokee Nation of Arkansas and Missouri.

Rob's reply

This is a longer version of a screed previously published by Lindsay and Yeagley. Since it contains additional mistakes and stereotypes, I've included it as a separate entry.

>> But, abuse of IGRA provisions has allowed tribes to go "reservation shopping" anywhere they want – anywhere prime gambling facility locations can be found. <<

This is a ridiculous overstatement of the alleged threat of "reservation shopping." See A Tribe Located Anywhere Could Open a Casino in Manhattan for a demolition of this claim and The Facts About Indian Gaming—Reservation Shopping for the lowdown on "reservation shopping."

>> Major national news investigations have been published, ranging from Time and Forbes to the New York Times and the Wall Street Journal. <<

See The Critics of Indian Gaming—and Why They're Wrong for a demolition of the claims made by Time, the New York Times, and the Wall Street Journal.

>> These reports describe how tribal government actions have caused soil erosion, water shortages, snarled traffic and increased crime. <<

Soil erosion? You can be sure any problems with soil erosion have nothing to do with running a casino.

See Hard Evidence that Indian Gaming Works for the overall benefits of Indian gaming to local communities.

>> We would like to believe Congress did not intend federal "trust" status of tribally purchased land to enable autonomous (often syndicated) gambling operations to dominate the economy and social character of surrounding communities. <<

Stereotype alert! I'm not sure what a "syndicated" gambling operation is, but it sounds like a hint that the mob is involved. Hence the implication is that Indian casinos are corrupt and crime-ridden.

>> But, "sovereign immunity" shelters tribal trust land from taxation and virtually all state laws and local regulation. <<

Yes...so? States are immune from being regulated by other states and by Indian tribes. Should we repeal all these immunities so that every state and tribe can regulate every other state and tribe?

>> Tribal leaders and their coercive, out-of-state casino investors are, thus, responsible only to themselves for their actions. <<

Wrong. If tribes are immune from most state laws, they aren't immune from most federal laws. They're responsible to uphold the state compacts they sign and to obey directives from the Dept. of the Interior, the Dept. of Justice, the FBI, their own regulatory commissions, state gaming commissions, and the National Indian Gaming Commission.

>> The lower prices offered by Indian businesses attract non-Indian clientele, thus shrinking state and local tax receipts <<

To prove this, Lindsay and Yeagley would have to prove that people would've spent their money in the trust land-adjacent businesses if they hadn't spent it on the trust land. In all likelihood, these people wouldn't have left their homes if the casino hadn't attracted them. They would've spent their money in businesses near their homes, not in trust land-adjacent businesses.

Lindsay and Yeagley haven't begun to address the complexities of people's economic behavior. I doubt they've even considered it. Instead, they've made up claims they can't support with evidence.

>> and contributing to an addictive behavior that severely strains local social services. <<

Don't hold your breath waiting for Lindsay and Yeagley's denunciation of non-Indian gaming, which controls 2/3 of the industry and presumably causes 2/3 of gambling addictions.

Tribal businesses = scofflaws?

>> Tribal businesses typically refuse to collect or remit state and local sales taxes (even though the U.S. Supreme Court has ruled four times that tribal businesses are lawfully required to both collect and remit taxes on purchases made by their non-tribal customers). <<

The following testimony sheds some light on the issue:

Testimony of Susan M. Williams

On Behalf of the National Congress of American Indians

On the Collection of State Transactions Taxes

by Tribal Retail Enterprises

Before the United States House of Representatives

Committee on Resources

October 12, 1999

The rule regarding state taxation of transactions between Indian sellers and non-Indian buyers is more complex. In these cases, the test is dependent on the specific facts presented in the case concerning the impacts of a state tax on federal and tribal interests and on the purposes of the particular state tax.(3) In sales of goods such as cigarettes and motor fuels, if the legal incidence of the tax falls on the tribe, the tax is barred.(4) If the incidence of the tax falls on the non-Indian purchaser, the Supreme Court has held that the state tax is lawful, even though the sale took place on an Indian Reservation, and that tribes may be required to make reasonable efforts to assist in collection of the tax.(5)

Tribal governments fundamentally disagree with this interpretation of the relative taxing authorities of the tribes and states. The current test requires tribes to choose between their need to tax on-reservation transactions, which results in double taxation when the state also imposes its tax and impairs the tribes' ability to be competitive in attracting businesses to the reservation, or forgo the tax, and with it an important revenue stream. As this paradox demonstrates, with any state tax, the true incidence of the tax falls on tribal governments regardless of where the legal incidence is found to lie. It is important to note that states, in the exercise of their inherent authority, may choose not to collect an otherwise valid tax. As a result, a number of states have opted not to collect the taxes, sometimes with the requirement that the tribal government collect a similar tax in order to promote price parity.

Indian tribes also object to the imposition of state taxes because it contributes to the loss of revenue from reservations to state coffers. On most reservations, there are few retail stores; tribal members go off reservation and pay state taxes on everything they buy. Nationwide, this amounts to $246 million annually in tax revenues to state governments, while states expend only $226 million annually on behalf of reservation residents.(6) The Supreme Court's rulings requiring tribes to collect state taxes on cigarette and motor fuels when non-members purchase these goods on the reservation exacerbate this situation. This approach provides no parity for tribal governments and adds to the many institutional pressures that keep Indian reservations among the poorest communities in the country.

>> California faces the same threat to its future. <<

Ridiculous. California's Indian reservations are too far from major population centers to threaten the gas and cigarette sales of non-Indians.

>> According to the Federal Election Commission, Indian tribes are now the largest contributors to our election campaigns nationwide, exceeding even the largest labor and teachers' unions. <<

See Indian Gaming Is the "Nation's Largest Special-Interest Group" for a demolition of this absurd claim.

>> In California's gubernatorial recall race several years ago, the Agua Caliente gave $2 million and the Santa Rosa Tribe $1 million to Cruz Bustamante, far in excess of the state's $49,500 limit on campaign contributions to a single candidate in a single race. <<

And yet, Bustamante lost.

>> But Congress appears to have given "tribal sovereignty" a primacy that supersedes American citizenship. <<

Ridiculous. To grossly oversimplify, tribes can't pass laws affecting states and states can't pass laws affecting tribes. Where's the "primacy" in this perfectly neutral arrangement?

Note how Lindsay and Yeagley put tribal sovereignty in quotes as if it's not real at all. They aren't just trying to rein in tribal sovereignty, they're trying to eliminate it.

>> This privilege has grown in direct proportion to the growth of casino revenues. <<

Has it? How do you prove such an amorphous claim?

And even if it has, tribal sovereignty existed long before gaming became an issue. Although Lindsay and Yeagley imply it started with gaming, it's been a reality since the Supreme Court recognized it starting in the 1820s. <<

Yeagley opposes sovereignty...again

>> Politicians, enticed (and intimidated) by tribal campaign contributions, have allowed a vast expansion of tribal "sovereignty," and the extension of immunities on tax, land-use laws and business regulations.

Here we have an excellent example of how Yeagley, the Indian apple and Uncle Tomahawk, opposes his fellow Indians.

>> Congress never intended this result. <<

Sure it did, or it would've corrected the situation by now.

>> The lure of a tax-free casino has created a flurry of self-defined tribes, all suddenly rediscovering themselves – with the help of outside billionaires anxious to cash in on the tax-free "Indian" casino. <<

Only 20 tribes have been recognized since the passage of IGRA in 1988. Some 540 tribes were recognized before then. Lindsay and Yeagley have nothing to say about them, even though they comprise the vast majority of gaming tribes. Lindsay and Yeagley are using a tiny minority of tribes to bash Indians as a whole.

>> This is the era of the "pop-up" Indian tribe, which doesn't even have to be Indian. <<

It's also the era of the "pop-up" Indian critic, which explains how Lindsay and Yeagley stay in business.

>> They also lurk outside congressional offices, influencing federal policies to expedite tribal recognition and fee-to-trust land conversion decisions. <<

And yet most recognition decisions take years and go against the tribes seeking recognition. I wonder why that is if tribes dominate the process.

>> The result of misconceived sovereignty laws is a "gold rush" of off-reservation Indian casinos across the country, especially in California. <<

If so, this must be the smallest gold rush in history. Linsday and Yeagley must mean there's a "gold rush" of off-reservation proposals. Few of these will ever get enacted so they're only a hypothetical problem, not a real one.

>> There are now 420 tribal casinos up and running in 30 states, with dozens more awaiting approval by federal bureaucrats. <<

Yes, and the vast majority of them belong to longstanding tribes, not "pop-up" tribes. Again, Lindsay and Yeagley have obscured this point by talking about the exceptional cases first as if they represent the whole.

>> The tribes are acquiring tens of thousands of acres in states across America, and the fee-to-trust process is adversely affecting local citizens as tax rolls diminish with each tribal parcel that is removed and given tax-exempt status. <<

I don't know where Lindsay and Yeagley got their "tens of thousands of acres" figure. They probably made it up.

Even so, 10,000 acres would equal roughly 200 acres per state, or 10 acres per county. This is a trivial amount of land taken off the tax rolls, not a huge amount.

>> "Sovereign" tribal gambling operations and their ancillary commercial enterprises remain accountable only to themselves. <<

And to the long list of government bodies mentioned previously.

>> In 2005, tribal casino revenue was $22.6 billion, twice the take of Nevada gaming. <<

But only 1/3 of the gaming industry as a whole.

>> Yet, the vast majority of Native Americans do not benefit from IGRA riches. <<

Yes, because gaming is a voluntary program meant to benefit only those who pursue it. And not to benefit every tribe whether it pursues gaming or not.

>> Many Indians have even been dis-enrolled from their tribes by greedy tribal leaders who know that fewer members means a bigger piece of the pie for each. <<

A few thousand out of the total Indian population of two million-plus have been disenrolled. Tribal leaders generally say it happens for reasons other than greed. And if greed were the motivating factor, why wouldn't "tribal leaders" disenroll everyone, not just a small minority of a tribe's membership?

>> Shall America be "one nation, indivisible" with equality under the law for all U.S. citizens, as intended by our Founding Fathers, or will we instead allow a greedy American aristocracy to use Indians tribes to crush other Americans, thus degrading the whole country and destroying all respect for Indian people? <<

The Founding Fathers intended the USA to treat Indian nations the same as foreign nations. They said so in the Constitution.

Related links

Yeagley the Indian apple

The facts about Indian gaming

|

. . . |

|

All material © copyright its original owners, except where noted.

Original text and pictures © copyright 2007 by Robert Schmidt.

Copyrighted material is posted under the Fair Use provision of the Copyright Act,

which allows copying for nonprofit educational uses including criticism and commentary.

Comments sent to the publisher become the property of Blue Corn Comics

and may be used in other postings without permission.